Teaching Kids About Money Through Parental Financial Teamwork

Understanding Value

Grasping the concept of money's worth forms the bedrock of financial literacy. This goes beyond price tags to encompass the true cost of goods and services - the labor, materials, and time invested in their creation. Consider how a child's handmade card, while inexpensive, carries emotional weight that store-bought alternatives can't match. This early lesson plants seeds for appreciating both monetary and intrinsic value throughout life.

Recognizing Needs vs. Wants

The ability to differentiate necessities from luxuries shapes sound financial judgment. Essentials like nutritious meals, safe housing, and weather-appropriate clothing form the non-negotiables, while entertainment systems and designer outfits represent discretionary spending. Teaching children this distinction helps them develop prioritization skills that prevent impulse buying and foster responsible consumption habits.

The Power of Saving

Cultivating saving habits builds more than just bank balances - it develops patience and goal-setting skills. Whether aiming for a bicycle, summer camp, or college fund, the process of setting aside money teaches children that meaningful achievements require time and discipline. Regular saving, even in small amounts, creates powerful neural pathways connecting effort with reward.

Earning Money

Age-appropriate work experiences transform abstract financial concepts into tangible realities. From household chores to neighborhood services like pet care or yard work, children learn that income represents exchanged value. This hands-on approach demonstrates the direct relationship between effort and compensation while nurturing work ethic and self-reliance.

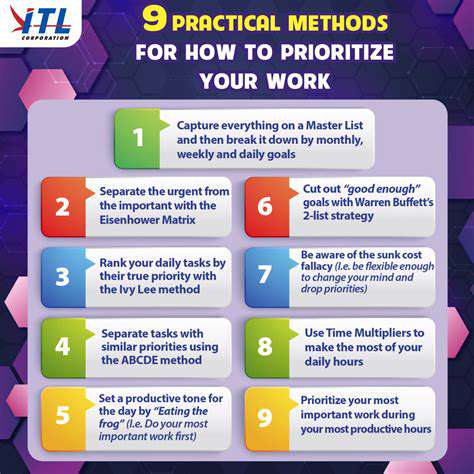

Managing Money Through Budgeting

Simplified budgeting introduces children to resource allocation principles they'll use lifelong. Visual tools like labeled jars or color-coded charts make abstract concepts concrete, showing how money can be divided between immediate wants, future goals, and charitable giving. These early exercises develop critical thinking about financial trade-offs and opportunity costs.

Modeling Sound Financial Habits: Parental Teamwork

Creating a Shared Vision

Financial education begins with parental alignment on money values and priorities. Regular money meetings help couples synchronize their approaches to saving, spending, and financial goal-setting. This unified front prevents mixed messages and creates consistency in the financial behaviors children observe daily. When both parents demonstrate the same principles, children internalize these lessons more deeply.

Modeling Responsible Spending

Children absorb financial behaviors through daily observation more than formal instruction. Demonstrating comparison shopping, explaining purchase deliberations aloud, and showing restraint with impulse buys all teach powerful lessons. Occasionally including children in age-appropriate financial discussions - like comparing grocery prices or evaluating vacation options - makes them active participants in the decision-making process.

Establishing a Budget and Saving Habits

Family budgeting becomes educational when made visible and interactive. Simple visual aids like percentage-based pie charts or progress thermometers for savings goals help children grasp abstract concepts. Starting with their own allowances or earnings, children can practice dividing money into categories, learning that financial planning is about making intentional choices rather than restrictions.

Encouraging Saving for Goals

Goal-oriented saving transforms abstract discipline into concrete achievement. Help children identify short-term (toys), medium-term (electronics), and long-term (college) targets, then track progress visually. Celebrating milestones reinforces positive behavior - consider matching funds for reached goals to demonstrate how savings can multiply. These experiences build the delayed gratification muscles crucial for financial success.

Teaching About Debt and Credit

Early debt education should balance caution with practicality. Explain borrowing through relatable examples - like how saving for a bike takes six weeks but borrowing means paying for eight weeks due to interest. For older children, demonstrate credit card statements showing how minimum payments prolong debt. These tangible lessons prevent abstract financial concepts from becoming theoretical.

Promoting Financial Literacy Resources

Complement lived experiences with curated educational materials. Seek out engaging books like The Berenstain Bears' Trouble With Money for younger children or How to Turn $100 Into $1,000,000 for teens. Quality apps and board games like Monopoly or The Game of Life make learning interactive. Local credit unions often offer youth programs that combine fun with practical money skills.

Encouraging Financial Independence: Empowering Kids to Take Control

Understanding the Importance of Financial Independence

True financial freedom means making life choices unconstrained by monetary limitations. This autonomy allows pursuit of meaningful work, calculated risks, and lifestyle preferences without financial stress dictating decisions. Achieving it requires developing both money management skills and the psychological resilience to handle financial uncertainties. The journey begins with recognizing that financial independence isn't about wealth accumulation, but about creating options.

Creating a Solid Financial Foundation

Building financial stability starts with mastering cash flow management. Detailed tracking of income against expenses reveals spending patterns and potential savings opportunities. The 50/30/20 rule (needs/wants/savings) offers a simple framework beginners can adapt as their situation evolves. Emergency funds covering 3-6 months of expenses create crucial buffers against life's unpredictability, while consistent investing - even small amounts - harnesses compound growth over time.

Developing Smart Spending Habits

Conscious spending aligns expenditures with personal values and long-term objectives. Techniques like the 24-hour rule for non-essential purchases or value-based budgeting help curb impulsive buying. Regular spending audits identify money leaks - those small, habitual expenses that collectively drain significant resources annually. Teaching children these evaluation skills helps them develop what psychologists call financial mindfulness.

Investing for the Future

Long-term wealth building relies on understanding investment fundamentals. Start with explaining how different vehicles work - savings accounts preserve capital while stocks offer growth potential. For hands-on learning, consider simulated investing platforms or small real investments in companies children understand (like their favorite tech or toy companies). The key lesson isn't picking winners, but understanding how investments can work systematically over decades.

Managing Debt Effectively

Strategic debt management distinguishes between productive borrowing (education, home ownership) and consumptive debt (credit card balances). Teach the snowball (smallest debts first) and avalanche (highest interest first) repayment methods, showing how each affects total interest paid. For older teens, explain credit scores as financial report cards that impact future opportunities. These lessons help prevent the debt traps that derail many young adults.

Seeking Professional Guidance

Financial advisors serve as navigators for complex money matters. When selecting one, look for fee-only fiduciaries obligated to act in clients' best interests. Involve older children in meetings to demystify professional financial planning. This exposure teaches that seeking expert help demonstrates financial maturity, not weakness. Many advisors offer family services, helping bridge generational wealth knowledge gaps.

Read more about Teaching Kids About Money Through Parental Financial Teamwork

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit