Emergency Fund Savings Targets for Married Households

Understanding Your Joint Financial Situation

When couples marry, their finances often become intertwined, yet it's vital to examine both individual and combined incomes, expenses, and debts to establish practical emergency fund targets. Scrutinizing spending patterns—covering fixed and variable costs—reveals opportunities to trim expenses and redirect funds toward savings. This encompasses everything from housing payments and utility bills to groceries, transportation, and leisure activities. Existing debts like student loans, credit card balances, or personal loans must be factored in when prioritizing savings and crafting a holistic financial strategy.

Considering Household Expenses and Obligations

Shared household costs extend beyond rent or mortgage payments. Utilities, groceries, insurance premiums, and other recurring expenses demand equal attention. Anticipate unpredictable costs like vehicle repairs or medical bills that could destabilize your finances. A comprehensive grasp of these expenditures ensures you allocate sufficient emergency funds without compromising daily necessities.

Estimating Potential Unexpected Costs

Emergency reserves exist to cushion life's surprises. Consider medical crises, unemployment, car troubles, or appliance failures. While predicting every scenario is impossible, projecting probable expenses based on your lifestyle creates a pragmatic safety net. This might include home repairs, pet emergencies, or replacing essential appliances. Realistic estimates lead to achievable savings goals.

Establishing Your Savings Goals and Timeline

After evaluating finances and potential risks, define concrete savings objectives. Determine the amount needed for financial security during emergencies and set a feasible timeline. A structured savings plan with monthly targets maintains focus and prevents overwhelm, while visualizing progress sustains motivation.

Prioritizing Needs Over Wants

Financial strain demands clear distinction between essentials and luxuries. Reallocating resources from discretionary spending to emergency savings can dramatically accelerate fund growth. Regularly assess whether expenses serve critical needs or represent adjustable lifestyle choices.

Considering Future Financial Goals

While emergency funds provide immediate security, they should align with long-term objectives like home purchases or major investments. A well-structured emergency fund serves dual purposes: crisis protection and goal advancement. Integrating short-term and long-term planning creates financial synergy.

Reviewing and Adjusting Your Plan Regularly

Financial landscapes evolve with career changes, family dynamics, and personal circumstances. Periodic reassessment of your emergency fund ensures continued relevance. This may involve increasing contributions, modifying spending habits, or adjusting timelines—flexibility is key to maintaining an effective safety net.

Calculating Your Emergency Fund Target: A Practical Approach

Understanding Your Needs

Financial security begins with a substantial emergency reserve, shielding against unforeseen events like medical issues, unemployment, or vehicle breakdowns. Start by thoroughly analyzing monthly expenditures—housing costs, utilities, food, transportation, and debt obligations. Detailed budgeting illuminates cash flow patterns and reveals optimization opportunities.

This financial audit exposes vulnerabilities while distinguishing necessities from discretionary spending. Proactive planning enables crisis navigation without sacrificing essentials. With clear financial awareness, you can establish realistic emergency fund objectives.

Estimating Your Emergency Fund Duration

While 3-6 months' expenses is standard guidance, personalize this based on job stability, dependents, and future commitments. Stable employment with minimal debt may warrant smaller reserves, whereas volatile income or significant obligations necessitate larger buffers. Extended coverage periods provide greater resilience during prolonged financial disruptions.

Determining Your Emergency Fund Amount

Multiply monthly expenses by your chosen coverage period—for instance, $3,000 monthly costs over six months equals $18,000. Treat this as a baseline, adjusting for unique circumstances and potential scenarios. Incorporate existing savings strategically to reduce accumulation time.

Account for possible family support and unexpected overages—a slightly inflated target creates valuable breathing room. Regular reviews ensure your fund adapts to life changes, maintaining adequate protection as circumstances evolve.

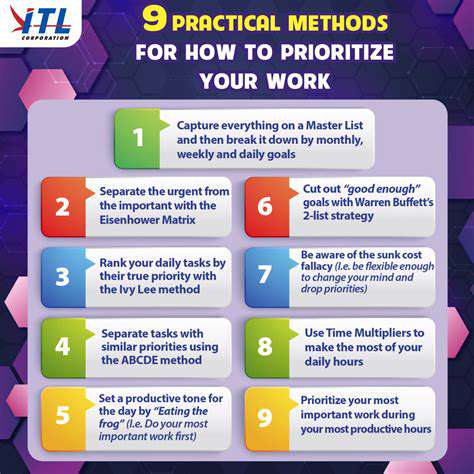

Prioritizing Savings: Strategies for Success

Setting Realistic Financial Goals

Effective saving begins with SMART objectives—specific, measurable, achievable, relevant, and time-bound targets. Instead of vague intentions, aim for concrete goals like $500 for a laptop down payment by December. Precision creates accountability and measurable progress, transforming abstract aspirations into actionable plans.

Budgeting and Tracking Expenses

Comprehensive budgeting—whether through apps, spreadsheets, or journals—reveals spending patterns and optimization opportunities. Regular budget audits maintain alignment between spending habits and financial priorities, allowing timely adjustments for income fluctuations or unexpected costs.

Automating Savings

Scheduled transfers to savings accounts create consistent, effortless accumulation. This behavioral approach leverages inertia to overcome spending temptations, embedding saving into financial routines. The psychological impact of out of sight, out of mind proves remarkably effective for long-term growth.

Creating an Emergency Fund

A 3-6 month expense buffer forms the foundation of financial resilience. This safety net prevents crisis situations from derailing other financial objectives, providing stability during turbulent periods.

Investing Wisely

Once basic savings are established, consider diversified investments to combat inflation and build wealth. Balanced portfolios tailored to risk tolerance can accelerate goal achievement while managing potential downsides.

Reducing Debt

High-interest liabilities sabotage savings potential. Aggressive debt repayment—particularly for credit cards—frees substantial resources for wealth-building. Methodical approaches like the debt snowball method create psychological wins that sustain momentum.

Seeking Professional Advice

Financial advisors provide customized strategies for complex situations. Their expertise helps navigate investment options, tax implications, and goal prioritization, often identifying opportunities that individuals might overlook. This guidance proves particularly valuable during major life transitions or when managing substantial assets.

Read more about Emergency Fund Savings Targets for Married Households

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit