Inflation Proof Budget Adjustments for Married Households

Controlling Utilities and Transportation

Utility bills contain numerous hidden savings opportunities. Conducting a home energy audit often reveals surprising inefficiencies - I recently helped a client save 22% on their electric bill simply by sealing drafty windows. Transportation costs likewise respond well to creative solutions. Switching to a telecommuting arrangement just two days weekly can slash fuel and maintenance expenses by 40%. For necessary commutes, apps like GasBuddy help locate the cheapest fuel, while carpool matching services turn solitary drives into shared expenses.

Negotiating Other Essential Expenses

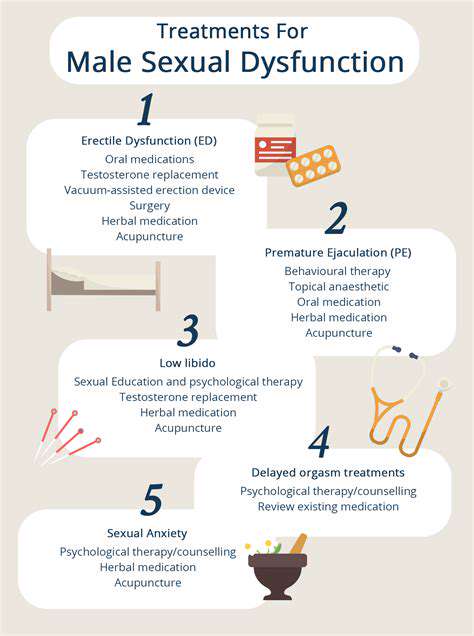

Many essential services contain negotiable components that most consumers never question. Medical providers often offer cash discounts or payment plans if asked directly. Insurance premiums can frequently be reduced by increasing deductibles or bundling policies. One often-overlooked tactic: request your current provider to match competitors' rates - this works surprisingly often in industries like internet service and mobile plans. Always remember that the listed price is frequently just the starting point for negotiation.

Implementing a Budget-Conscious Spending Strategy

Budgeting Basics for Sustainable Spending

Mastering budgeting fundamentals transforms financial stress into control. The most effective budgets don't feel restrictive - they align spending with personal values. Start by tracking every expense for 30 days to identify spending patterns (most people underestimate discretionary spending by 20-30%). Then implement the 50/30/20 framework: 50% for needs, 30% for wants, and 20% for savings/debt repayment. This flexible structure accommodates different lifestyles while ensuring financial progress. Review and adjust monthly - your budget should evolve with your circumstances.

Strategies for Cutting Unnecessary Expenses

Trimming expenses requires both one-time actions and ongoing habits. Conduct a subscription audit - the average household wastes $200 monthly on unused memberships. Negotiate better rates on services you keep (success rates exceed 80% for cable/internet packages). Implement a 48-hour waiting period for nonessential purchases - most impulse buys lose their appeal given time. For recurring expenses, try the downgrade challenge: use the basic version of services for a month before deciding if premium features justify their cost. You'll often discover you don't miss what you thought was essential.

Long-Term Financial Planning and Goals

True financial security comes from aligning daily spending with future aspirations. Visualizing specific goals (like a debt-free date or retirement scenario) makes budget sacrifices feel meaningful. Automate savings to treat them as non-negotiable expenses - even $50 weekly grows to $13,000 in five years at modest returns. Diversify your financial foundation by allocating funds across emergency savings (3-6 months' expenses), retirement accounts, and accessible investments. Remember that small, consistent actions compound dramatically - increasing your savings rate by just 1% annually can add years to your retirement timeline.