Measuring ESG Impact with Integrated Supply Chain Tech

Advanced Analytics for Impact Assessment and Reporting

Leveraging Data for Strategic Decisions

Advanced analytics provides a powerful toolkit for organizations to gain deeper insights into their operations and customers. By leveraging sophisticated algorithms and statistical models, businesses can identify hidden patterns, trends, and correlations that would otherwise remain undetected. This capability allows for more informed strategic decision-making, leading to improved efficiency and profitability.

Understanding customer behavior and preferences through advanced analytics is crucial for tailoring products and services to meet evolving demands. This data-driven approach can also help organizations optimize resource allocation, identify potential risks, and anticipate market shifts. A successful implementation of these techniques can significantly enhance a company's competitive advantage.

Predictive Modeling for Future Forecasting

Predictive modeling is a key component of advanced analytics, enabling organizations to forecast future outcomes and trends. This capability is invaluable for various business functions, including sales forecasting, risk management, and customer churn prediction. By analyzing historical data and identifying patterns, organizations can anticipate future events and make proactive decisions to mitigate risks and capitalize on opportunities.

Predictive models can significantly improve operational efficiency by anticipating potential bottlenecks and proactively addressing them. It also allows for more effective resource allocation, leading to cost savings and increased productivity. For example, by predicting equipment failures, organizations can schedule maintenance proactively, minimizing downtime and maximizing equipment lifespan.

Predictive modeling can be applied to many business functions, from inventory management to supply chain optimization, enhancing efficiency and responsiveness. It facilitates proactive decision-making, enabling businesses to anticipate challenges and capitalize on opportunities.

Optimizing Business Processes Through Data Visualization

Data visualization is a critical aspect of advanced analytics that converts complex data into easily understandable and actionable insights. Visual representations of data, such as charts, graphs, and dashboards, provide a clear overview of key trends, patterns, and performance indicators. These visualizations allow stakeholders to quickly grasp the key information and make informed decisions about the business's performance and future direction.

By presenting data in a visually appealing and easily digestible format, data visualization tools empower stakeholders to identify areas requiring improvement, spot emerging trends, and make data-driven decisions. This translates to enhanced decision-making processes and better overall business performance.

The power of data visualization lies in its ability to connect data to business strategies, enabling stakeholders to identify key areas for improvement and develop targeted interventions. By visualizing key performance indicators, organizations can quickly identify areas of concern, track progress toward goals, and make data-informed decisions that directly impact the bottom line.

Driving Continuous Improvement and Transparency

Driving Continuous Improvement

Continuous improvement in ESG (Environmental, Social, and Governance) reporting and impact measurement requires a proactive and iterative approach. Companies should regularly assess their current practices, identify areas for enhancement, and implement changes to strengthen their ESG performance. This ongoing evaluation allows for adaptation to evolving industry standards and stakeholder expectations, ensuring that ESG initiatives remain relevant and impactful over time. Regular feedback loops with stakeholders and internal teams are crucial to gather insights and refine strategies for maximum effectiveness.

Transparency in reporting is paramount to building trust and demonstrating accountability. Clear and concise communication of ESG performance, including both successes and challenges, fosters understanding and allows for constructive dialogue with investors, customers, and other stakeholders. This transparency goes beyond simply disclosing data; it also involves explaining the methodology used, the context of results, and the future plans for improvement.

Integrating ESG into Core Business Processes

A truly effective ESG program is not a standalone initiative, but rather an integral part of the company's operations. Integrating ESG considerations into core business processes ensures that environmental, social, and governance factors are actively considered in decision-making at all levels of the organization. This integrated approach fosters a culture of sustainability where ESG factors are not just addressed as an add-on, but are embedded in the very fabric of how the company operates.

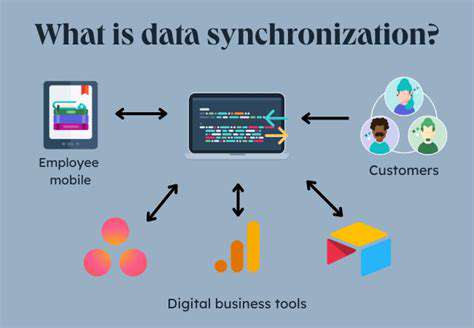

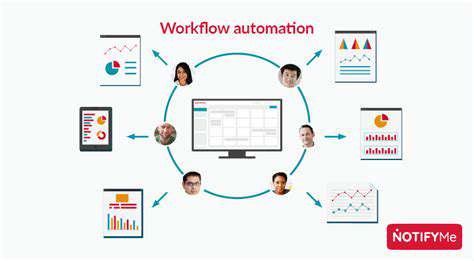

Implementing robust internal systems and reporting mechanisms for ESG data collection and analysis is also essential. This facilitates a clear understanding of current performance, areas needing improvement, and the impact of implemented changes. It allows for early identification of potential risks and opportunities related to ESG factors, enabling proactive management and strategic planning.

Utilizing Technology for Enhanced Transparency

Modern technology plays a vital role in enhancing ESG reporting transparency. Digital tools and platforms can automate data collection, analysis, and reporting processes, reducing manual effort and improving accuracy. This increased automation allows for more frequent and detailed reporting, enabling organizations to demonstrate continuous improvement and responsiveness to stakeholder concerns. Utilizing technology also allows for the integration of ESG factors into existing business intelligence systems, providing a holistic view of the organization's performance.

Measuring and Tracking Key Performance Indicators (KPIs)

Establishing clear and measurable Key Performance Indicators (KPIs) is essential for tracking progress and evaluating the effectiveness of ESG initiatives. These KPIs should be specific, relevant, achievable, time-bound, and measurable (SMART). By monitoring these KPIs regularly, companies can gain valuable insights into the impact of their strategies and identify areas where adjustments are needed. This data-driven approach allows for a more precise understanding of the ESG journey and the impact of implemented changes.

Stakeholder Engagement and Feedback

Meaningful stakeholder engagement is critical for driving continuous improvement and demonstrating transparency. Companies should actively solicit feedback from investors, customers, employees, and other stakeholders to understand their perspectives on ESG issues and incorporate their concerns into decision-making processes. This engagement allows for a more holistic understanding of ESG issues and fosters trust with various stakeholders. Active listening and responding to stakeholder feedback is essential for building trust and achieving long-term success.

Building a Culture of Accountability

A culture of accountability is vital for driving lasting change in ESG performance. This involves establishing clear roles and responsibilities for ESG initiatives, ensuring that all employees understand their part in contributing to positive change. Promoting open communication and fostering a supportive environment where employees feel empowered to raise concerns and share ideas is also crucial. These actions foster a sense of shared responsibility and encourage sustained commitment to ESG goals.

Read more about Measuring ESG Impact with Integrated Supply Chain Tech

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit