Teaching Teens Financial Literacy Through Parental Modeling

Retirement planning might seem like something far off in the future, but starting early is a huge advantage. Even small contributions to a retirement account now can have a massive impact on your financial security later in life. Retirement accounts often offer tax advantages, helping your money grow more quickly. This means planning ahead for the future is essential to making sure your future self has the opportunity for financial security.

Setting Financial Goals: Defining Your Future

Establishing clear financial goals is critical for any investment strategy. Whether it's saving for a car, a down payment on a house, or retirement, outlining these goals provides a roadmap for your financial decisions. Defining your goals gives you a direction and a sense of purpose in your financial journey. These goals should be both short-term and long-term, helping you stay focused and motivated to achieve them through your investments.

Importance of Budgeting and Saving

Budgeting and saving are fundamental to any sound financial plan, even for young people. Budgeting helps you track your income and expenses, allowing you to understand where your money is going and identify areas for improvement. Saving, even small amounts regularly, builds a financial cushion and allows you to accumulate funds for future needs or investments. Creating a budget and learning to save consistently is a valuable skill for future financial success and peace of mind. Consistent saving also sets you up for success in investment growth and retirement.

Managing Risk and Investing Wisely

Risk management is a crucial aspect of investing. It's about understanding the potential downsides of an investment and taking steps to mitigate those risks. Diversification, for example, spreads your investments across various assets, reducing the impact of any single investment's poor performance. Investing wisely involves due diligence and research. Understanding your comfort level with risk is essential when choosing investments. There are resources available to help you learn about and manage the different risks inherent in the financial world and to learn how to build your investments wisely.

Encouraging Open Communication and Honest Conversations

Fostering a Culture of Trust

Open communication is vital for any successful organization, fostering an environment where employees feel comfortable sharing their ideas and concerns without fear of retribution. Creating a culture of trust is paramount to encouraging open dialogue. This trust is built through consistent and transparent communication from leadership, demonstrating a genuine interest in employee well-being and offering avenues for feedback.

By actively listening to employees' perspectives, organizations can gain valuable insights that contribute to problem-solving and strategic decision-making. A healthy feedback loop is key to improvement and positive change within the workplace. This process of active listening will build strong, positive, and open communication channels.

Establishing Clear Communication Channels

Clearly defined communication channels ensure that information flows efficiently and effectively throughout the organization. This includes utilizing various communication methods such as email, instant messaging platforms, team meetings, and company-wide announcements to keep all employees informed on important matters.

Establishing clear protocols for different types of communication and designating specific channels for each type of message is essential to minimizing confusion and ensuring that everyone receives the appropriate information.

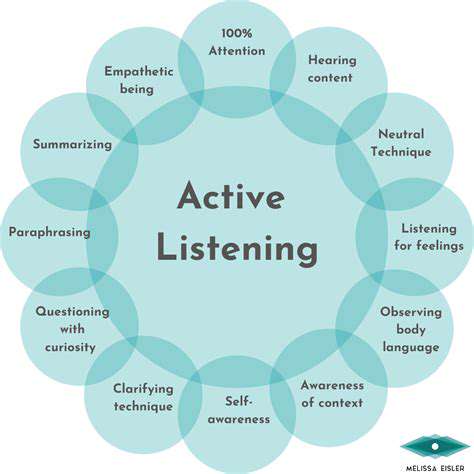

Encouraging Active Listening

Active listening goes beyond simply hearing what others say; it involves fully concentrating on the message, both verbal and nonverbal, and responding thoughtfully and empathetically. This involves paying attention to both the content of the message and the speaker's tone and body language.

Encouraging active listening fosters empathy and understanding within the team, allowing for more constructive and meaningful conversations. By truly listening to one another, employees can better comprehend different perspectives and ideas, leading to a more collaborative and innovative work environment.

Promoting Transparency and Honesty

Transparency and honesty are cornerstones of effective communication. Organizations should maintain open communication with all stakeholders, including employees, customers, and partners, to ensure that everyone is informed about important developments and decisions. Transparency fosters trust and strengthens relationships.

Honest communication builds credibility and trust. Leaders must be truthful and straightforward in their interactions with everyone to encourage a culture of openness and reliability.

Providing Opportunities for Feedback

Regularly scheduled feedback sessions, both formal and informal, allow employees to voice their opinions and concerns, ultimately improving company processes and employee satisfaction. These opportunities can include one-on-one meetings, surveys, suggestion boxes, or focus groups.

Gathering feedback from all levels of the organization provides valuable insights into strengths, weaknesses, and areas for improvement within the company.

Addressing Conflict Constructively

Conflict is inevitable in any workplace, but how it's addressed significantly impacts team dynamics and morale. Creating a safe space for employees to express differing opinions or concerns without fear of retribution is crucial. Open dialogue can mediate and resolve issues constructively.

Having clear guidelines and processes for addressing conflict, along with readily available resources for mediation, fosters a more positive and productive work environment. Implementing these methods demonstrates a commitment to conflict resolution within the organization.