Cryptocurrency Prenuptial Agreements for Digital Asset Protection

The Rising Importance of Cryptocurrency in Modern Relationships

The Evolution of Digital Currency in Personal Finance

Cryptocurrency is rapidly changing the landscape of personal finance, offering alternative avenues for investment and transaction processing. Gone are the days when people relied solely on traditional banking systems. Digital currencies like Bitcoin and Ethereum empower individuals to take control of their financial futures, potentially reducing dependence on middlemen and enabling faster, cheaper international transactions. This shift mirrors a broader move toward decentralization and financial independence in today's world, affecting not just personal finances but also relationships built around shared monetary objectives.

The accessibility and potential for substantial returns associated with cryptocurrency are capturing the attention of younger generations, potentially altering financial dynamics within families and romantic partnerships. This growing fascination with digital assets demands a deeper understanding of how these technologies can fit into existing financial plans, especially when it comes to building and maintaining relationships.

Navigating the Volatility of Crypto Investments

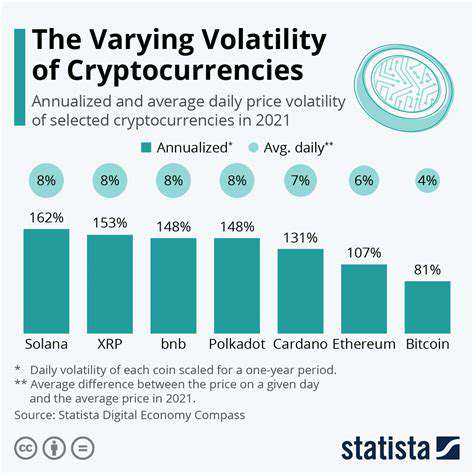

One major challenge with cryptocurrency is its inherent instability. Price swings can be extreme and unpredictable, creating significant risks for investors. This volatility requires careful thought and a solid grasp of market trends before diving into cryptocurrency investments. Setting realistic expectations and investing wisely are crucial to minimizing losses while pursuing potential gains. This factor plays a pivotal role in modern relationship dynamics, particularly when couples share financial goals involving cryptocurrency.

Risk management is vital for healthy financial partnerships. Clear communication and mutual agreement on investment approaches are essential for dealing with cryptocurrency's unpredictable nature. These factors can either strengthen relationships or create tension when partners disagree on investment strategies.

Cryptocurrency and the Future of Shared Finances

The incorporation of cryptocurrency into personal finances is poised to transform how couples manage shared finances. As digital currencies gain mainstream acceptance, we'll likely see new approaches to joint accounts, budgeting, and even inheritance planning. This evolution requires adaptation and open conversations about cryptocurrency's role in shared financial objectives. Couples and families may need to rethink traditional financial models and develop new strategies that include these emerging technologies.

The Ethical Considerations of Cryptocurrency Transactions

Cryptocurrency's decentralized nature raises unique ethical questions. Issues like anonymity, transaction security, and potential illegal uses require careful thought. These concerns must be addressed within relationships, especially when partners share financial responsibilities. Honest discussions about responsible cryptocurrency use and associated risks are necessary for building trust and maintaining healthy financial partnerships.

Cryptocurrency as a Tool for Global Financial Inclusion

Beyond individual finances, cryptocurrency could promote worldwide financial access. In areas with limited traditional banking, cryptocurrency offers alternative methods for transactions and money transfers. This aspect might influence cross-cultural relationships and international partnerships, potentially bridging financial gaps and creating more inclusive economic opportunities. The integration of cryptocurrency into global financial systems will likely reshape international relationships and financial collaborations.

Defining Cryptocurrency Holdings in Prenuptial Agreements

Understanding Cryptocurrency's Evolving Legal Landscape

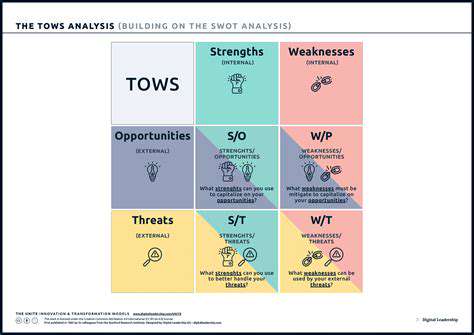

Cryptocurrency, with its decentralized structure and rapid development, presents special challenges and opportunities when defining assets in prenuptial agreements. Its unstable nature, changing market values, and relative newness mean traditional legal frameworks for asset definition and valuation might not fully cover cryptocurrency complexities. This requires a thoughtful approach to ensure agreements accurately reflect intentions and remain legally sound as cryptocurrency laws evolve. Since legal standards for digital assets are still developing, consulting an attorney specializing in family law and cryptocurrency is essential.

The absence of established valuation methods for cryptocurrency could lead to future disputes. Prenuptial agreements must specify how cryptocurrency will be valued when the agreement is made and potentially during separation or divorce. This valuation should be clearly defined, documented, and ideally involve an independent qualified appraiser. Agreements should also address how future cryptocurrency acquisitions will be treated—whether as separate or shared property—and who holds ownership rights. This foresight helps prevent future conflicts and maintains clarity about each party's rights and obligations.

Strategies for Defining and Valuing Cryptocurrency in Prenups

When including cryptocurrency in prenuptial agreements, thoroughness is key. Simply mentioning cryptocurrency holdings isn't enough. Agreements should explicitly list specific cryptocurrencies involved, including relevant blockchain addresses or wallet identifiers when possible. This detailed approach prevents confusion and ensures all parties understand exactly which assets are being addressed. A precise definition of cryptocurrencies is fundamental for creating a solid prenuptial agreement.

Agreements should also establish a valuation method. Will valuation be based on market price when the agreement is signed, or another benchmark? This section should specify the chosen valuation approach, including which exchange or platform will determine prices. This clarity helps prevent valuation disputes and ensures transparency. Since cryptocurrency values can change dramatically, agreements should explain how these fluctuations will be handled during marriage and in case of separation or divorce.

Additionally, agreements should consider future cryptocurrency acquisitions. Will new holdings be treated as separate or shared property? The agreement should clearly define these scenarios to prevent future disagreements and remain valid as cryptocurrency holdings change.

Finally, agreements should outline each party's responsibilities for managing cryptocurrency holdings during marriage. This clarity prevents conflicts about asset management. Will one partner handle wallet management or investments? These details are critical and must be explicitly stated.

Seeking Legal Counsel for Comprehensive Protection

Seeking Legal Counsel for Comprehensive Legal Guidance

Navigating legal complexities can be challenging, requiring specialized knowledge and experience. Consulting a qualified attorney is crucial for obtaining thorough legal guidance. A skilled lawyer can help you understand your rights and responsibilities, offering clarity and support throughout the process. This proactive approach often prevents problems from worsening and leads to better outcomes.

Legal representation provides essential protection, ensuring your interests are effectively advocated. Understanding legal procedures and potential consequences of your actions is vital, and a lawyer can help you make informed decisions. Failing to seek legal advice might lead to negative outcomes with significant financial or personal consequences.

Understanding Your Specific Legal Needs

Before hiring a lawyer, identify your exact legal requirements. Consider the nature of your legal issue, potential consequences, and desired results. Are you dealing with a dispute? Do you need help with a contract? Understanding these details helps you communicate your needs clearly to your attorney.

Choosing the Right Legal Expert

Selecting a qualified, experienced attorney is crucial for achieving positive results. Consider their expertise in your specific legal area. Research their background and client feedback to assess their competence and success rate. Interview multiple lawyers before deciding. This process helps you find someone whose skills and approach match your needs.

Preparing for Your Consultation

Thorough preparation for your consultation is important. Gather all relevant documents like contracts, agreements, or correspondence related to your legal matter. Prepare a list of specific questions and concerns to maximize your consultation time.

Being well-prepared shows your commitment and helps the attorney provide more focused, effective advice. A productive consultation leads to clearer understanding of your legal options.

Exploring Various Legal Options

A competent attorney will examine different legal approaches based on your situation and potential outcomes. They'll present various strategies, explaining pros and cons of each. This comprehensive review helps you make informed decisions aligned with your goals and risk tolerance. Exploring all possibilities is invaluable when dealing with legal matters.

Understanding the Cost and Timeline

Discuss legal fees and expected case duration with your attorney. Knowing the financial implications and projected timeline helps you make sound decisions and manage expectations.

Communicating Effectively with Your Attorney

Maintain open, consistent communication with your lawyer. Respond promptly to their questions and provide updates about your case. This proactive approach ensures your legal team stays informed and can represent you effectively. Good communication is fundamental to achieving successful legal results.

Read more about Cryptocurrency Prenuptial Agreements for Digital Asset Protection

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit