Legacy Planning Conversations All Mature Couples Need to Have

Defining Your Shared Values and Goals for the Future

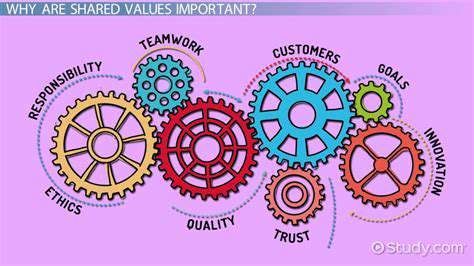

Defining Shared Values

Clearly defining your shared values is crucial for any successful collaborative project, be it a team, a partnership, or a community. These values act as a guiding compass, ensuring everyone is aligned on the principles that underpin your work. They provide a framework for decision-making, fostering a positive and productive environment.

When shared values are well-defined and understood, they create a strong foundation for navigating challenges and disagreements. They provide a common language and set of expectations that everyone can refer to, leading to greater clarity and cooperation.

Identifying Key Principles

Identifying key principles is the first step in articulating your shared values. This involves careful consideration of what truly matters to each individual and how these individual values can complement and converge to create a cohesive whole. It's about finding common ground and ensuring that everyone feels heard and respected.

Establishing a Framework for Decision-Making

A well-defined framework for decision-making, rooted in shared values, ensures that every choice aligns with the principles that guide your collective endeavor. This framework provides a structured approach to problem-solving and conflict resolution, ensuring that decisions are made thoughtfully and fairly.

This framework promotes a culture of transparency and accountability, enhancing trust and collaboration. It's a proactive step towards creating a shared understanding of how to move forward.

Creating a Culture of Transparency and Accountability

A culture of transparency and accountability is essential for building trust within the group. Open communication and clear expectations are key components of this culture. This involves ensuring everyone understands the roles, responsibilities, and the consequences of actions within the group. It fosters a sense of shared responsibility and encourages continuous improvement.

Promoting Open Communication and Collaboration

Open communication and collaboration are vital for ensuring that everyone feels heard and valued. Encouraging active listening, constructive feedback, and respectful dialogue fosters a strong sense of community and shared purpose. This atmosphere of collaboration also allows for diverse perspectives to be considered and for creative solutions to emerge.

Implementing and Enforcing Values

Implementing and enforcing shared values requires consistent action and a clear plan. This involves integrating the values into daily practices, decision-making processes, and conflict resolution strategies. Regular evaluation and adjustments to the implementation plan are crucial for ensuring the values remain relevant and effective. This demonstrates a commitment to upholding the principles that guide your shared goals.

Ensuring Long-Term Sustainability

To ensure the long-term sustainability of your shared values, it's important to regularly review and assess their effectiveness. This continuous evaluation helps to identify any areas where adjustments are needed to keep the values relevant and impactful. Regular communication and feedback loops are essential to maintain the shared commitment to these values. This continuous refinement ensures that the values remain a driving force behind the project.

Addressing Financial Matters and Asset Distribution

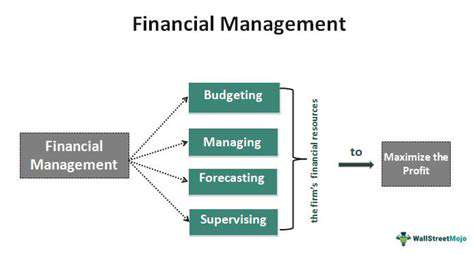

Addressing Financial Matters and Avoiding Debt

Financial literacy is crucial for individuals and families to navigate the complexities of modern life. Understanding budgeting, saving, and debt management strategies is paramount to achieving financial stability and avoiding accumulating debt. Many individuals find themselves struggling with debt, which can negatively impact their overall well-being and future opportunities. Proactive steps towards responsible financial management can alleviate such pressures and pave the way for a more secure financial future.

Developing a Realistic Budget

Creating a realistic budget is a fundamental step in managing personal finances effectively. This involves carefully tracking income and expenses to identify areas where spending can be adjusted. Understanding your income and expenses is crucial for making informed financial decisions. By carefully analyzing spending patterns, you can pinpoint areas for potential savings and allocate funds accordingly. This process fosters a deeper understanding of financial priorities and promotes responsible financial habits.

Strategies for Saving Money

Saving money consistently is essential for achieving financial goals, whether it's buying a home, funding education, or simply building a financial safety net. There are various strategies for saving, ranging from setting up automatic transfers to utilizing high-yield savings accounts. Diligent saving practices are key to achieving long-term financial security. By consistently saving a portion of your income, you're building a foundation for future financial stability and independence.

Understanding Different Types of Debt

Understanding the various types of debt—credit card debt, student loans, mortgages—is critical for developing a comprehensive debt management plan. Each type of debt has its own implications and repayment strategies. Knowing the terms and conditions of your debts is vital for effective management. Each type of debt carries different interest rates, repayment schedules, and potential consequences for missed payments. Recognizing these differences is essential for making informed decisions about debt repayment.

Debt Management Strategies

Debt management strategies can range from negotiating lower interest rates with creditors to utilizing debt consolidation services. Effective strategies are crucial for successfully managing debt and reducing its impact on your finances. Exploring different options, such as balance transfers or debt consolidation loans, can be helpful in streamlining repayment plans and minimizing the burden of debt. It's essential to weigh the pros and cons of each strategy to choose the one that best suits your individual financial circumstances.

Seeking Professional Financial Advice

When facing complex financial situations or unsure about the best course of action, seeking professional financial advice can be incredibly beneficial. Financial advisors can offer personalized guidance and support in developing a comprehensive financial plan. Professional guidance can be invaluable in navigating the complexities of financial decisions. They can help you understand various investment options, develop effective budgeting strategies, and create a long-term financial roadmap. This guidance can empower you to make informed decisions and achieve your financial goals.

Read more about Legacy Planning Conversations All Mature Couples Need to Have

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit