Recession Proof Financial Plans for Single Income Marriages

Tracking every dollar might feel tedious initially, but this practice builds financial awareness that lasts a lifetime. Consider using budgeting apps that link to your accounts, automatically categorizing transactions while you focus on living your life. The goal isn't restriction, but rather conscious spending that aligns with your true priorities.

Strategies for Saving on Essential Expenses

Reducing essential costs requires creativity rather than deprivation. For housing, consider house hacking (renting out spare rooms) or negotiating with landlords during lease renewals. Grocery bills shrink dramatically with meal planning, store brands, and shopping seasonal produce. Transportation costs can be halved through carpooling, bike commuting, or negotiating remote work days with employers.

Many families overlook assistance programs that could lower their essential expenses. From LIHEAP for utility bills to SNAP for groceries, these programs exist to help bridge temporary gaps. There's no shame in using available resources while working toward greater financial stability.

The Impact of Prioritization on Long-Term Goals

When essential expenses are properly managed, an amazing thing happens - financial breathing room appears. That extra $200 monthly might fund an IRA contribution or start a college savings plan. Financial security grows from these small, consistent decisions to fund necessities first and invest the remainder wisely.

This approach also reduces money-related stress, which researchers link to better health outcomes and stronger relationships. Knowing your rent is paid and fridge is stocked creates mental space to focus on career growth or personal development - the true building blocks of lasting prosperity.

Maintaining a Balanced Approach

Extreme frugality often backfires, leading to binge spending or lifestyle resentment. The healthiest budgets include modest allocations for enjoyment - whether that's occasional dinners out or a modest vacation fund. Financial wellness isn't about deprivation, but about aligning spending with personal values and long-term aspirations.

Consider implementing a fun fund that grows slowly but guarantees some discretionary spending each month. This prevents the all-or-nothing mentality that derails so many well-intentioned budgeters. Remember, the goal is sustainable financial habits, not temporary austerity.

Diversifying Income Streams and Exploring Side Hustles

Exploring Multiple Revenue Streams

In our volatile economy, multiple income streams act as financial shock absorbers. The pandemic taught us that even secure jobs can disappear overnight. Today's most financially resilient individuals typically have at least three income sources - their primary job, investment income, and some form of side work or business.

The digital revolution has democratized income opportunities in unprecedented ways. From renting out unused parking spaces to creating digital products that sell while you sleep, the options multiply daily. The key lies in matching opportunities with your available time, skills, and tolerance for risk.

Leveraging Existing Skills for Side Hustles

Your most marketable skills might be things you take for granted. That knack for organizing closets could translate into a professional organizing business. Fluent in another language? Translation services or teaching pay surprisingly well. The gig economy thrives on specialized knowledge that seems ordinary to you but valuable to others.

Platforms like TaskRabbit, Thumbtack, and even Nextdoor connect local service providers with eager customers. The initial time investment in creating profiles and gathering reviews pays dividends in steady side income. Remember to factor in all costs - including taxes and equipment - when pricing your services.

Developing a Side Business for Long-Term Growth

Transitioning from gig work to a true business requires strategic thinking. The most successful side businesses solve specific problems for defined audiences. Perhaps you notice parents struggling to find quality STEM toys - that could spark an educational product line. Maybe your corporate job gives you insights into underserved industry needs.

Scalability separates hobbies from businesses. Can you systemize processes? Train others to handle certain tasks? Create products that don't require your constant involvement? These factors determine whether your venture remains a side project or grows into something more substantial.

Survivor 48 exploded onto screens with contestants demonstrating unprecedented strategic depth from the opening moments. The premiere revealed several players who intuitively understood the social dynamics required for long-term success. Early frontrunners emerged through subtle but brilliant gameplay, forming alliances while maintaining plausible deniability. Viewers witnessed fascinating psychological maneuvers as competitors balanced tribe cohesion with individual ambition.

Developing a Long-Term Financial Plan and Investing Wisely

Understanding Your Financial Situation

Before charting any financial course, you need an accurate map of your current position. This means compiling all financial statements, loan documents, and investment accounts into one comprehensive overview. Many people discover forgotten accounts or unnecessary fees during this process. Financial clarity often reveals hidden opportunities - like refinancing high-interest debt or consolidating retirement accounts.

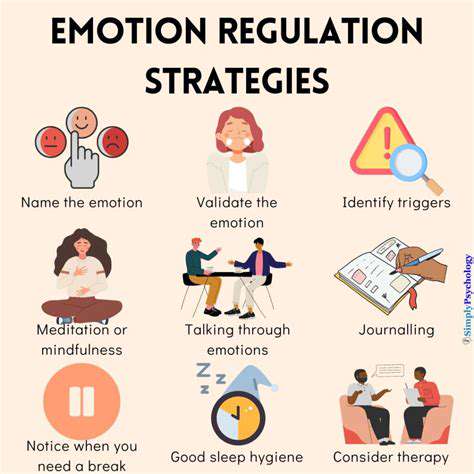

Don't neglect the psychological aspects of this assessment. Notice your emotional responses to different financial categories - does checking your retirement balance fill you with anxiety or confidence? These reactions offer clues about your money mindset and areas needing attention.

Setting Realistic Financial Goals

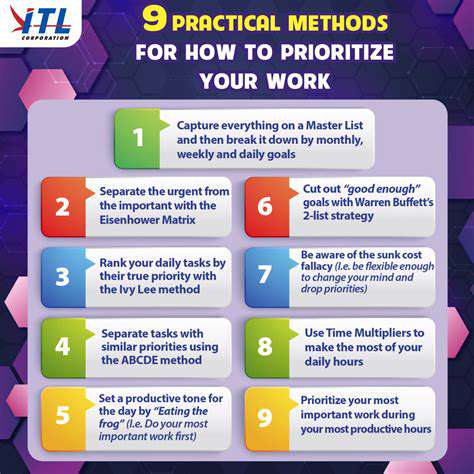

Effective goals follow the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of save more money, try increase 401(k) contributions by 2% before year-end. Break ambitious targets into quarterly milestones to maintain motivation. Celebrate small victories - they compound into significant progress.

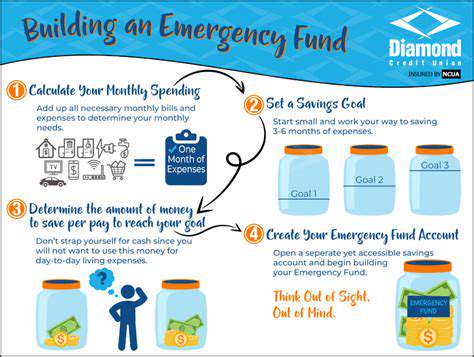

Prioritize goals that create financial flexibility, like establishing an emergency fund before aggressively paying down low-interest mortgage debt. This sequencing ensures you can handle unexpected expenses without derailing your entire plan. Remember that priorities shift over time - review and adjust goals annually.

Diversifying Investments for Recession Resilience

True diversification goes beyond owning different stocks. It spans asset classes (stocks, bonds, real estate, commodities), geographies, and market sectors. During the 2008 crisis, while U.S. stocks plummeted, certain international markets and bond categories held steady or even gained value. Rebalancing - periodically adjusting your portfolio back to target allocations - forces you to buy low and sell high systematically.

Alternative investments like farmland REITs or peer-to-peer lending can further diversify traditional portfolios. The key is understanding each investment's role in your overall strategy and how it might perform under different economic conditions. When one asset zigs, another should zag - that's the power of proper diversification.