Smart Contract Prenups for DAO Married Couples

Dispute Resolution and Exit Strategies within the Smart Contract

Dispute Resolution Strategies

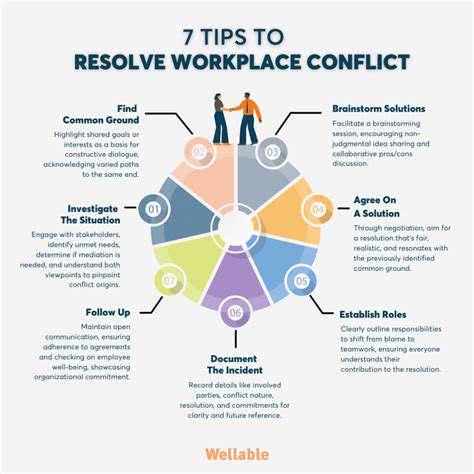

Effective dispute resolution is crucial for maintaining healthy business relationships and minimizing potential legal issues. Understanding the various approaches, from negotiation to arbitration, is vital for proactive conflict management. Choosing the right strategy depends on the nature of the dispute, the parties involved, and the desired outcome. Early intervention and clear communication are key to resolving disputes amicably.

Different approaches to dispute resolution offer varying levels of formality and control. Negotiation, for instance, allows parties to engage directly and potentially reach a mutually agreeable solution. Mediation involves a neutral third party to facilitate communication and encourage compromise. Arbitration, on the other hand, utilizes a neutral third party to make a binding decision.

Exit Strategies for Businesses

A well-defined exit strategy is essential for ensuring a smooth transition and maximizing value in the event of a sale, merger, or liquidation. Planning for the future of a business is critical, and an exit strategy should be considered from the outset of the business's lifespan. This planning process should include identifying potential buyers, assessing the business's value, and outlining the steps needed to facilitate the transition.

Various exit strategies cater to different business objectives and circumstances. Some options include selling the business to a strategic buyer, merging with another company, or liquidating assets. Each option has distinct advantages and disadvantages, and careful consideration should be given to the specific needs and goals of the business.

Negotiation Tactics

Negotiation is a fundamental aspect of dispute resolution and often the first step in resolving conflicts. Successful negotiation involves active listening, clear communication, and a willingness to compromise. Knowing when to walk away from a negotiation is just as important as knowing when to push forward.

Effective negotiators understand the importance of building rapport and establishing trust with the other party. Understanding their needs and motivations can help in crafting a mutually beneficial solution. Strong negotiation skills are valuable assets for anyone involved in business dealings.

Mediation Processes

Mediation provides a structured environment for facilitating communication and finding common ground between disputing parties. A neutral mediator guides the process, helping parties articulate their concerns and explore potential solutions. Mediation is often a more cost-effective and less adversarial approach compared to litigation. It fosters a collaborative atmosphere where parties can achieve a mutually acceptable outcome.

The mediator's role is to ensure that all parties have an opportunity to be heard and that communication remains productive. Mediation can be particularly useful in situations where maintaining a relationship is crucial. It's an excellent approach for resolving disputes in a variety of contexts, from family matters to complex business disagreements.

Arbitration Procedures

Arbitration offers a more formal dispute resolution method where a neutral arbitrator makes a binding decision. This process can be faster and less expensive than litigation, and it often provides a more focused and efficient approach to conflict resolution. Arbitration is often preferred when parties need a quicker and more definitive outcome than mediation. This method is especially suitable for complex commercial disputes.

Arbitration procedures typically include a hearing, where evidence is presented, and the arbitrator considers the arguments before rendering a decision. The decision is legally binding, and the parties are generally required to adhere to it. This process is often faster and more cost-effective than traditional litigation.

Exit Strategy Planning

Developing a comprehensive exit strategy requires careful consideration of various factors, such as the business's financial performance, market conditions, and the potential for future growth. Understanding the potential challenges and opportunities associated with different exit strategies is essential for effective planning. The strategy must align with the overall goals of the business owners and stakeholders.

A well-structured exit strategy should include a detailed plan for transferring ownership, managing assets, and ensuring a smooth transition. This process requires expert advice from legal and financial professionals to ensure that all aspects are addressed properly. Thorough planning minimizes potential risks and maximizes the value of the business during the exit process.

Read more about Smart Contract Prenups for DAO Married Couples

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit