Legal Preparations All Married Couples Need for Crisis Scenarios

6 Legal Protection Strategies Couples Must Understand During a Crisis

1. Draft a Comprehensive Will

The Core Value of a Will in Times of Crisis

When life encounters significant changes, a comprehensive will acts like a compass at sea, ensuring that your wishes are carried out. According to recent research by the American Bar Association, about 60% of adults do not have a will, meaning that courts might distribute assets according to rigid legal texts instead of honoring the true wishes of the family.

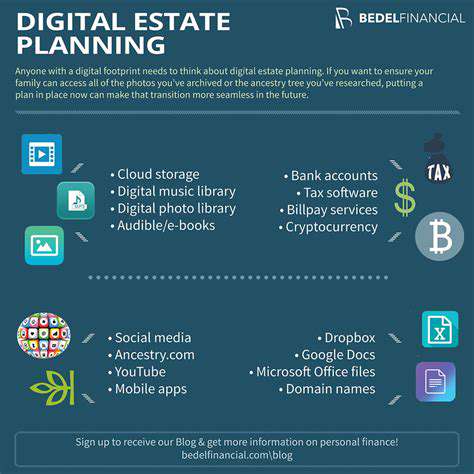

A well-crafted will can not only avoid inheritance disputes among relatives but also designate guardians for minor children. When an unexpected event occurs, clear written instructions serve as a sedative, effectively alleviating family anxiety. It is particularly important to pay attention to the provisions regarding digital assets (such as cryptocurrencies and social media accounts), which have become indispensable in modern wills.

Three Essential Elements of a Will

Creating a legally binding will requires including three golden modules: First, you must meticulously inventory all assets like an archaeologist, leaving no stone unturned from real estate to digital wallets. It is advisable to invite professional appraisers to assess special assets such as collectibles and artworks to avoid court disputes among heirs over valuation discrepancies.

When selecting an executor for the will, be as cautious as if choosing a lead surgeon. This role requires both financial acumen and communication skills; it is best to select someone familiar with family dynamics and prepare an emergency plan in advance—if the primary executor suddenly becomes unavailable, there should be an alternate ready to step in immediately.

Contemporary Will Maintenance Strategies

Life is like the changing of the seasons, and wills need regular check-ups too. In addition to major life events such as changes in marital status, you should promptly update documents if an heir has not contacted you for three consecutive years or if there's a change in the family business's equity structure. It is recommended to adopt a 3+1 reminder mechanism: a thorough revision every three years + immediate updates for significant events.

Establishing a long-term cooperative relationship with a professional lawyer is crucial. They act like legal navigators, providing timely reminders of new estate tax policy changes. The recently passed California 'Digital Assets Inheritance Bill' has left many families with outdated wills at a disadvantage.

2. Establish a Durable Power of Attorney

A Dual Insurance Mechanism for Financial Security

A Durable Power of Attorney (DPOA) is the Swiss Army knife of crisis management. When an unexpected stroke or serious accident leads to unconsciousness, it allows the designated agent to immediately take over financial decision-making. The brilliance of this legal tool lies in its dual-trigger mechanism—covering both routine transactions and emergency medical authorizations.

Four-Step Customization Process for Power of Attorney

When drafting a power of attorney, it is recommended that couples conduct a decision pressure test: simulate a sudden unconsciousness scenario to observe whether the agent can quickly respond to complex situations such as mortgage delinquencies and tax filings. When choosing an agent, beyond trust, you should also evaluate their crisis management skills—like selecting a co-pilot who must remain calm in turbulence.

The wording of legal documents should be as precise as a scalpel. The high-profile Smith couple case that shocked the nation was due to vague definitions in the DPOA regarding medical decisions, resulting in the agent lacking the authority to terminate life support. This case warns us that professional lawyers' meticulous reviews are indispensable.

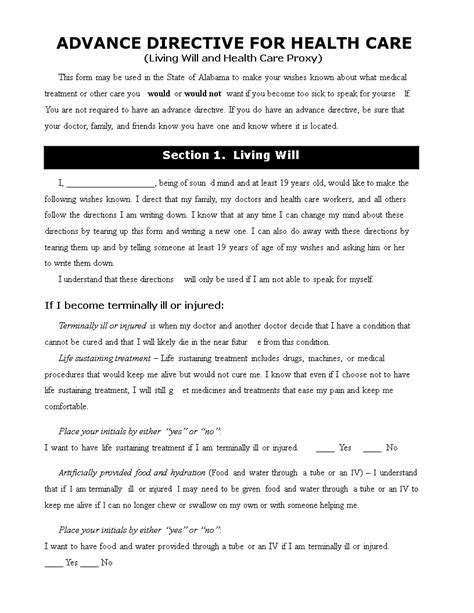

3. Establish a Healthcare Proxy

The Gold Standard for Life Decisions

A healthcare proxy is not a cold legal document, but rather a life declaration full of human warmth. It is advisable to use scenario-based planning: discuss in detail with the agent about 20 common critical conditions such as being in a vegetative state or late-stage cancer to ensure that every medical decision reflects your life philosophy.

The recent case from Massachusetts General Hospital is worth following: A patient specified in the proxy that if the risk of developing dementia due to treatment exceeded 40%, they would forgo surgery. This precise quantitative standard prevented the family from facing a moral dilemma during the emergency.

4. Dynamic Management of Beneficiaries

The Invisible Traps of Beneficiary Designation

Updating beneficiaries is like upgrading software for financial accounts. A shocking case last year involved an investment bank executive who failed to update their 401K beneficiary, leading to a substantial retirement fund going to an ex-wife, eight years divorced. It is recommended to establish a life event response mechanism: arrange for a lawyer to modify relevant documents on the day of weddings/divorces.

5. The Wisdom of Marital Property Agreements

The New Trend in Prenuptial Agreements

Modern prenuptial agreements have expanded beyond asset division to encompass emerging areas like pet custody and social media account inheritance. A tech mogul included a clause in their agreement stating that if the marriage faltered, both parties must jointly delete all intimate photos—this clause later became a model in Silicon Valley.

Legal experts remind us: Every document should keep a physical + cloud + lawyer-stored copy, and inform two emergency contacts of the storage location. Regularly conduct document drills to simulate whether family members can quickly access key documents in the event of emergencies.

Read more about Legal Preparations All Married Couples Need for Crisis Scenarios

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit