Digital Estate Planning for Tech Dependent Married Households

Outline

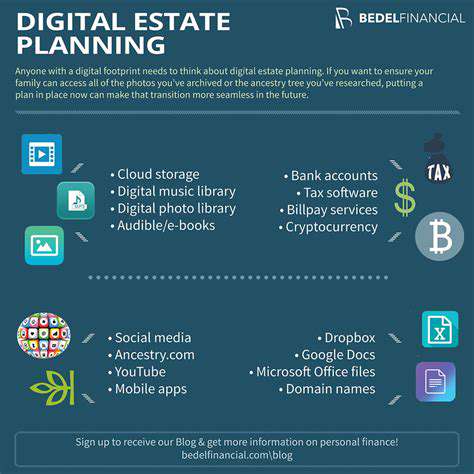

- Digital assets encompass online accounts, cryptocurrencies, and digital files

- Creating an asset inventory can significantly simplify the estate management process

- There are significant regional differences in the legal treatment of digital assets

- Digital trusts can enhance the efficiency of asset distribution

- Digital assets, including cryptocurrencies, carry tax risks

- Training heirs in advance can prevent subsequent operational chaos

- Digital inheritance plans need dynamic maintenance and updates

- Professional tools ensure secure information storage

- Designating a digital estate executor is crucial

- Privacy protection is a core element of planning

The Key Role of Digital Assets in Estate Planning

Understanding the Scope of Digital Assets

In today's internet age, digital assets encompass a wide range from online banking accounts and social media to cryptocurrencies. These virtual properties can carry emotional memories as well as considerable economic value, and their proper management directly affects the effectiveness of estate planning. With the popularity of blockchain technology and cloud storage, neglecting the management of digital assets can lead to serious legal repercussions.

Most people are still unaware that there are crucial clues hidden within their digital footprints—from cloud photo albums to cryptocurrency wallets, every account can become a trigger for estate disputes. If access plans are not deployed in advance, important data could be lost forever in the digital tide.

Building a Systematic Management Framework

It is recommended to adopt a layered management strategy: first establish a three-dimensional inventory that includes platform names, account credentials, and asset valuations. This dynamic record should be updated in sync with physical assets, with suggestions for quarterly reviews and adjustments. Practical operations can be maintained using Excel spreadsheets or specialized estate management software.

- Classify and label assets by platform type

- Store access credentials using AES-256 encryption

- Set up biometric verification for access rights

- Backup core data through a notary office

Legal Response Strategies

The disposal of digital inheritance faces a significant legal vacuum. Taking the Meta platform as an example, its legacy contact functionality is only available in certain regions, and operational timelines have strict limitations. It is recommended to clearly document the disposal plans for each platform in notarial documents and, if necessary, to provide screen recording demonstrations of the operations. For cross-border digital assets, applicable legal clauses should be explicitly noted.

In practice, some game accounts may not be inheritable based on user agreements. In such cases, it is a safer choice to convert virtual assets into physical assets in advance (e.g., cashing out through official trading platforms).

The Digital Extension of Trust Mechanisms

Establishing a digital trust can effectively bypass the probate process. By incorporating cryptocurrency wallets and domain ownership into the trust structure, beneficiaries can gain disposal rights within as little as 72 hours. This mechanism is particularly suitable for digital assets requiring immediate action, such as preventing social media accounts from being maliciously deactivated. Trust documents should also include digital estate liquidation clauses that clarify processing procedures for various scenarios.

Identifying and Managing Tax Risks

For example, the appreciation of Bitcoin may trigger both capital gains tax and estate tax. Under the new 2023 IRS regulations, virtual currency transactions exceeding $10,000 must be reported, making it especially critical to accurately record the acquisition costs and timestamps of each digital asset. It is advisable to hire accountants experienced in blockchain tax to assist with planning.

Building a Digital Estate Management System

In-Depth Analysis of Digital Footprints

Modern digital footprints are expanding at a rate of 23% per year, encompassing vast amounts of data from smart home configurations to autonomous driving preferences. Digital inheritance planning must first classify data: categorizing assets into three main sectors: financial (PayPal balance), memory (iCloud photos), and functional (domain names). It is suggested to use mind-mapping tools for visual organization.

Valuation Methodology

For new asset types like NFTs, it is recommended to reference the average transaction price on trading platforms over the last six months for valuation. Emotional value assets can be assessed using a memory density evaluation method—grading based on the time-space span of photos and videos and the relevance of individuals. Professional evaluation agencies now offer notarization services for digital estates, which can produce legally binding valuation reports.

Emergency Response Mechanism Development

It is recommended to set up a dual-factor trigger mechanism: when biometric monitoring (e.g., a smart bracelet detects a stopped heartbeat) coincides with manual confirmation (verification by two designated contacts), the estate disposal procedures are automatically activated. Cloud memos should include device unlocking tutorials and second verification bypass plans as operational guides.

Executor Training System

Digital estate executors need to undergo systematic training that includes skills like cold wallet operation and dual verification解除. It is recommended to produce instructional videos with time locks that automatically send to designated contacts after specific triggering conditions are met.

Preferred Digital Asset Management Tools

Asset Inventory Technical Solutions

It is recommended to use blockchain indexing tools to automatically extract accounts from various platforms and generate relational diagrams. For cryptocurrency assets, offline signing devices combined with multi-signature plans should be employed to ensure private keys are absolutely secure.

Tool Selection Criteria Analysis

- Compliance with GDPR/CCPA data standards

- Provision of judicial notarization interfaces

- Cold/hot storage separation mechanisms

- Biometric compatibility

Tests have shown that the travel mode of 1Password can quickly hide sensitive data, and the emergency access feature of LastPass supports setting activation delays, which are both worth considering.

In-Depth Legal Considerations

Pathways for Digital Asset Confirmation

The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), widely adopted by states in the U.S., provides legal bases for estate executors. However, note that this statute conflicts with the jurisdiction of the EU's General Data Protection Regulation, and legal clauses for cross-border digital assets should be established in advance.

Privacy Protection Balancing Techniques

It is recommended to adopt an onion model data layering approach: core financial data should use military-grade encryption, social accounts should have three-year automatic deletion clauses, and private communications should employ end-to-end encryption coupled with timed destruction features. For legal identity verification, consider blockchain notarization services that bind access rights to DNA characteristics.

Read more about Digital Estate Planning for Tech Dependent Married Households

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit