Joint vs Separate Bank Accounts: What Financial Experts Recommend

Tax Implications and Estate Planning Considerations

Understanding Tax Implications

Tax implications are a crucial aspect of estate planning, as they can significantly impact what beneficiaries ultimately receive. Failing to account for potential tax liabilities might leave heirs with unexpected financial burdens. The complex web of federal, state, and sometimes local tax laws requires careful navigation.

Different asset types trigger different tax treatments - retirement accounts, real estate, and investments each have unique rules. For instance, inherited property gets stepped-up basis for capital gains calculations, while IRA distributions count as taxable income. Strategic planning can preserve thousands of dollars that might otherwise go to taxes.

Estate Tax Considerations

The federal estate tax currently affects only the wealthiest estates, but many states impose their own inheritance taxes with much lower thresholds. These taxes can take a significant bite out of inheritances if not planned for properly. The rules change frequently, making regular reviews of your estate plan essential.

Proper use of trusts, gifting strategies, and beneficiary designations can legally minimize or even eliminate estate taxes in many cases. For larger estates, more sophisticated techniques like family limited partnerships or charitable remainder trusts might make sense.

Gift Tax Implications

The annual gift tax exclusion ($17,000 per recipient in 2023) allows substantial wealth transfer without tax consequences. Lifetime gifts of appreciated assets can be particularly tax-efficient, as they remove future appreciation from your taxable estate. Medical and educational expenses paid directly to institutions don't count against these limits.

Income Tax Implications for Beneficiaries

Heirs often face surprise tax bills, especially when inheriting retirement accounts or property that has appreciated significantly. Required minimum distributions from inherited IRAs create taxable income that beneficiaries must plan for. Understanding these obligations helps prevent financial strain during an already difficult time.

Trusts and Their Tax Advantages

Revocable living trusts avoid probate but offer no tax benefits, while irrevocable trusts can provide significant tax savings at the cost of flexibility. Special needs trusts preserve government benefits, and dynasty trusts can protect assets for multiple generations. The right trust structure depends entirely on your specific goals and family situation.

Impact of State and Local Taxes

Residents of states with inheritance taxes (like Pennsylvania or New Jersey) face additional planning challenges. Even modest estates might owe taxes in these jurisdictions, making proper titling of assets and beneficiary designations critically important. Some states also impose their own estate taxes with exemptions much lower than the federal level.

Practical Advice and Choosing the Right Approach

Practical Tips for Effective Planning

Good planning transforms overwhelming projects into manageable steps. Start by identifying your ultimate goal, then work backward to determine the necessary milestones. Writing down your plan increases commitment and provides a reference point when you feel stuck. Regular progress checks help maintain momentum and allow for necessary adjustments.

Breaking large goals into 90-day sprints with specific objectives makes progress more measurable. Celebrate small wins along the way to maintain motivation. The most effective plans balance structure with flexibility - rigid plans often fail when unexpected challenges arise.

Choosing the Right Tools

Technology should simplify your process, not complicate it. For collaborative projects, platforms like Trello or Asana help teams stay organized. Individual planners might prefer bullet journals or simple spreadsheet systems. The best tool is the one you'll actually use consistently - complexity often leads to abandonment.

Consider your working style - visual thinkers benefit from kanban boards, while list-makers thrive with task managers. Integration across devices ensures you can access your system anywhere. Automation tools can handle repetitive tasks, freeing mental energy for more important work.

Prioritizing Tasks and Managing Time

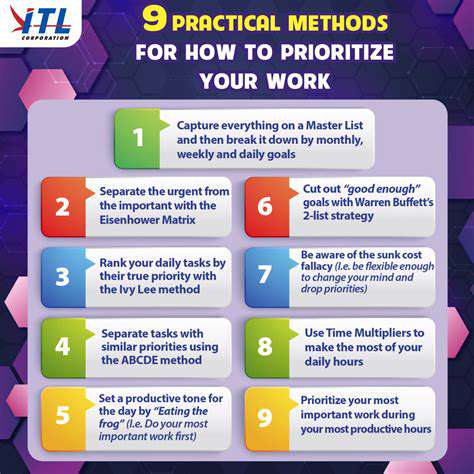

The Pareto Principle (80/20 rule) suggests that 20% of your efforts typically produce 80% of results. Identifying these high-impact activities transforms productivity. Time-blocking your calendar for deep work sessions protects these priorities from getting crowded out by less important tasks.

Learning to say no to good opportunities creates space for great ones. The Eisenhower Matrix helps distinguish between what's truly urgent versus what simply feels pressing. Most people discover they waste significant time on tasks that don't meaningfully advance their goals.

Delegation and Collaboration

Effective delegation starts with clear instructions and defined outcomes. Matching tasks to team members' strengths boosts both results and job satisfaction. Regular check-ins prevent small misunderstandings from becoming major problems. Documenting processes makes delegation easier in the future.

Collaboration thrives when participants feel psychologically safe to share ideas. Establishing meeting norms (like no devices) improves engagement. The best collaborations often happen when diverse perspectives combine to create solutions no individual would have conceived alone.

Adaptability and Flexibility

Rigid plans often break under real-world pressures. Building in buffer time and alternative approaches prepares you for inevitable surprises. The most successful planners view obstacles as information rather than failures - each challenge teaches how to improve the next attempt.

Developing a growth mindset helps you pivot when circumstances change. Regularly asking What's working? and What needs adjustment? keeps your approach fresh. Sometimes the most productive response to changed conditions is complete reassessment rather than minor tweaks.

Read more about Joint vs Separate Bank Accounts: What Financial Experts Recommend

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit