Digital Nomad Visa Planning for Globetrotting Couples

Financial Planning for a Smooth Transition

Understanding Your Financial Needs

One of the most overlooked yet critical steps in preparing for a digital nomad visa is conducting a thorough financial self-assessment. This means going beyond surface-level budgeting to analyze your spending habits, income stability, and potential hidden costs. The reality is that most visa rejections stem from inadequate financial preparation - something that could be avoided with proper planning.

Create a detailed spreadsheet tracking all potential expenses:- Visa application fees (including potential legal consultation costs)- Mandatory health insurance requirements- Proof of funds requirements (typically 3-6 months of living expenses)- Currency exchange rate fluctuations- Unexpected relocation costs

Building an Emergency Fund

Conventional wisdom suggests 3-6 months of expenses, but digital nomads should aim higher. Consider these factors when calculating your emergency fund:1. Local healthcare costs in your destination country2. Potential equipment replacement (laptops, phones)3. Emergency travel funds (for family emergencies back home)4. Visa extension processing times and associated costs

The psychological benefit of a robust emergency fund cannot be overstated - it provides the mental freedom to focus on building your new life rather than worrying about finances.

Diversifying Income Streams

Successful digital nomads typically maintain multiple income sources. Consider these proven models:- Retainer clients (providing stable monthly income)- Productized services (scalable offerings)- Digital products (courses, templates, ebooks)- Affiliate marketing (within your niche)- Remote employment (part-time or contract basis)

The key is creating income streams that complement rather than compete with each other, allowing for natural synergies in your work.

Visa-Specific Financial Considerations

Different countries have varying financial requirements for digital nomad visas. For example:- Portugal's D7 visa requires proof of passive income- Estonia's Digital Nomad Visa has minimum income thresholds- Mexico's Temporary Resident Visa requires bank balance proof

Pro tip: Always verify current requirements directly with official government sources, as policies change frequently. Bookmark the official immigration websites for your target countries and check them monthly for updates.

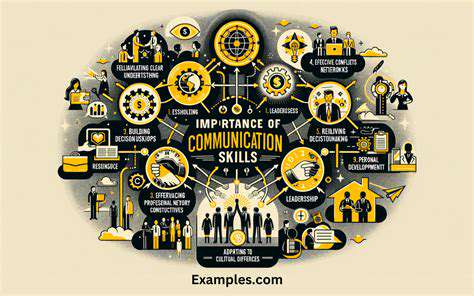

Open communication fosters emotional intelligence and healthy familial bonds.

Maximizing Your Time and Resources: Strategic Planning for Couples

Defining Your Shared Goals

The most successful digital nomad couples operate like a small business - with clear KPIs and regular check-ins. Try this exercise:1. Independently list your top 5 personal and professional goals2. Compare lists and identify overlapping priorities3. Create a joint vision board (digital or physical)4. Establish quarterly review meetings to track progress

Alignment doesn't mean identical goals - it means complementary objectives that support each other.

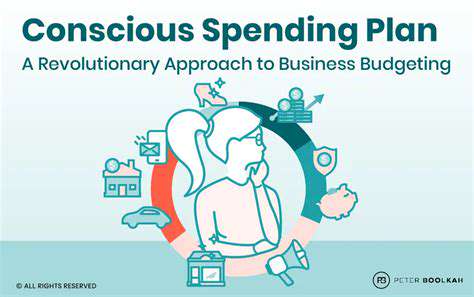

Budgeting for the Digital Nomad Lifestyle

Traditional budgeting methods often fail for location-independent couples. Instead, try:- The 50/30/20 rule (adjusted for travel)- Location-based cost averaging- Separate adventure and stability funds- Joint and individual discretionary accounts

Track expenses using apps like Trail Wallet or You Need A Budget (YNAB), customized for nomadic living.

Optimizing Time Management Across Locations

Time zone differences can be an asset if managed properly. Consider:- Implementing focus blocks during overlapping work hours- Designating no work zones (certain days or locations)- Using time tracking tools to identify productivity patterns- Scheduling regular digital detox periods

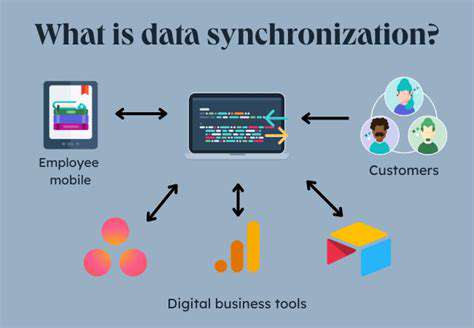

Leveraging Technology for Efficiency

Essential tech stack for digital nomad couples:- Communication: Slack (for work), Signal (personal)- Project Management: ClickUp or Notion- Document Sharing: Google Workspace- VPN: ExpressVPN or NordVPN- Password Manager: Bitwarden or 1Password

Embracing Flexibility and Adaptability

Develop a Plan B framework for common scenarios:- Internet outages- Health emergencies- Visa complications- Relationship stress points- Workload imbalances

The ability to pivot is more valuable than any pre-planned itinerary.

Building a Support Network

Create concentric circles of support:1. Inner circle: Other nomad couples2. Middle circle: Local connections3. Outer circle: Online communities

Join platforms like Nomad List, Digital Nomad Girls, or location-specific Facebook groups before arriving in a new destination.

Read more about Digital Nomad Visa Planning for Globetrotting Couples

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit