Practical Strategies for Managing Joint Finances in Marriage

Defining Your Individual Financial Goals

Creating a shared financial vision starts with each person understanding their own money aspirations. This requires deep self-reflection and honest conversations. What do you want to achieve in the next few years versus decades from now? Maybe you're putting money aside for a home, your kids' schooling, or your golden years. Getting crystal clear about these personal objectives forms the bedrock of a financial plan that works for everyone involved. These discussions need vulnerability - sharing not just dreams but also financial realities, worries, and hopes. When both partners truly grasp what motivates the other financially, they can start building toward a united future.

Timing matters just as much as the goals themselves. Picture when you'd like to hit major milestones, whether that's purchasing property or sending a child to university. Having these target dates in mind helps craft practical strategies and creates a step-by-step guide to reach them. The more precise you can be about what you want and when, the easier it becomes to map out how to get there.

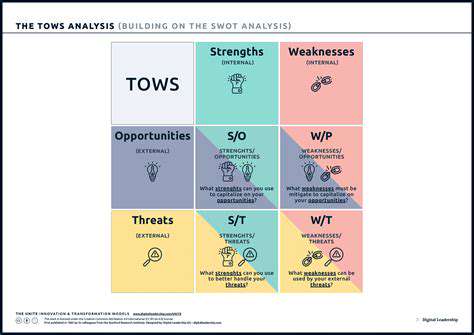

Identifying Shared Values and Priorities

While personal goals are important, discovering where your financial values overlap is equally crucial. Does retirement savings take precedence over current lifestyle spending? Have past money experiences shaped how you view finances today? Talking openly about these underlying beliefs helps prevent future conflicts. For instance, one person might prefer playing it safe with investments while the other wants to take more risks. Recognizing these natural differences leads to balanced decision-making.

Your shared financial philosophy extends beyond dollars and cents. How do you both feel about spending versus saving? Do your approaches to household budgeting complement each other? Aligning these fundamental money mindsets helps prevent arguments and ensures you're working toward common objectives. This process strengthens your partnership by making sure financial choices reflect what matters most to both of you.

Developing a Joint Budget and Financial Plan

With individual goals understood and shared values identified, it's time to create a combined budget and financial roadmap. Start by listing all income sources and every regular expense. This comprehensive view highlights where you might trim spending, boost savings, or find new earning opportunities. A thorough budget acts like a financial mirror, showing your current reality so you can plan your next moves wisely.

Beyond the budget, craft a detailed action plan with specific steps to reach your goals. Include realistic timelines, measurable checkpoints, and clear responsibilities for each person. Smart planning means preparing for the unexpected too - build in contingency options for life's surprises. This living document serves as your financial GPS, keeping you on route toward your shared destination.

Communicating and Reviewing Your Financial Vision

Honest, ongoing dialogue forms the backbone of successful financial partnership. Schedule regular check-ins to discuss progress, hurdles, and necessary adjustments. These conversations create a safe space to voice concerns, share ideas, and course-correct when needed. Treating your financial plan as an evolving document ensures it stays relevant as your life changes - through career shifts, growing families, or unexpected expenses.

Establish consistent communication habits, whether that's monthly finance meetings, joint budget reviews, or weekly money chats. This structured approach keeps both partners informed and engaged, building trust through transparency. When financial discussions become routine rather than reactive, you maintain alignment and keep working as a true team toward your shared vision.

Developing a Debt Management Strategy: Prioritizing and Consolidating

Prioritizing Debts

Smart debt management begins with strategic prioritization. Examine each debt's interest rate, minimum payment, and remaining balance. Target high-interest debts first - like credit cards with variable rates - to minimize total interest paid over time. This focused approach tackles your costliest obligations upfront, creating maximum financial relief.

Consider additional factors like loan terms, prepayment penalties, and credit score impacts when ranking debts. A thorough evaluation of all obligations helps craft an effective payoff plan. By understanding each debt's specific terms, you can design a strategy that efficiently reduces interest costs while maintaining financial stability. This methodical approach prevents feeling overwhelmed and keeps progress measurable.

Debt Consolidation Options

Consolidating multiple debts into one loan with better terms can simplify repayment. A well-chosen consolidation loan might lower your interest rate and reduce monthly payments. But proceed carefully - compare all options thoroughly, scrutinizing interest rates, fees, and repayment terms to avoid costly mistakes. Always read the fine print to spot hidden charges or unfavorable conditions.

Before consolidating, honestly assess your ability to maintain payments. Consider potential income changes or unexpected expenses that could strain your budget. Understanding the long-term implications helps ensure consolidation actually improves rather than worsens your financial health. While consolidation can create organizational benefits, it requires disciplined planning to be truly helpful.

Balance transfer credit cards offer another approach, often with introductory low rates. However, beware of short promotional periods and transfer fees. These cards work best as part of a broader strategy, not as standalone solutions. Always calculate what the interest will jump to after the introductory period ends.

Personal loans from banks or credit unions present another consolidation path. Shop around for the best rates and terms, being wary of loans that might ultimately cost more than your current debts. Understand how the loan will affect your credit score before committing.

Finally, recognize that consolidation isn't always the answer. If the new interest rate isn't substantially better, you might not save money overall. Sometimes the psychological benefit of simplified payments outweighs the financial math, but other times it's better to stick with your current repayment approach. Weigh all factors carefully before deciding.

Choose plants for harmony and balance in Feng Shui.

Read more about Practical Strategies for Managing Joint Finances in Marriage

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit