AR Assisted Home Renovation Planning Tools for Spouses

Effective Communication Strategies

Clear communication goes beyond word exchange - it's about ensuring messages land as intended. True understanding emerges when we listen actively, acknowledge different viewpoints, and adjust our delivery to suit the situation. Empathy forms the bedrock of meaningful dialogue, creating connections that transcend surface-level interactions.

Overcoming Communication Barriers

Breakdowns often occur when invisible walls stand between speakers. Language differences, cultural assumptions, and emotional baggage can all distort messages. Personal biases act like filters, coloring how we interpret what others say. Breaking through requires conscious effort - simplifying jargon, checking assumptions, and creating space for clarification.

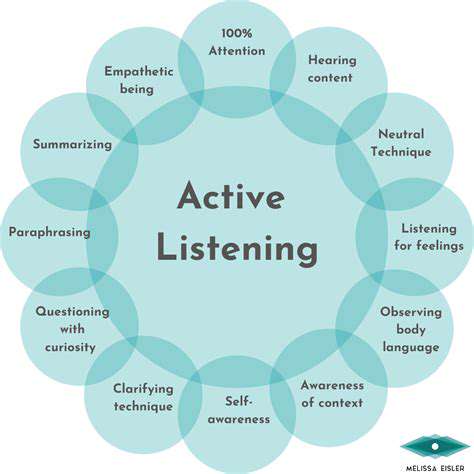

Active Listening Techniques

Real listening demands full presence. It's about catching the unspoken cues - the pauses, the body language, the tone shifts. When we give someone our undivided attention, we create fertile ground for genuine exchange. Simple acknowledgments (I see what you mean) build bridges more effectively than rushed solutions.

Building Rapport and Trust

Trust grows in environments where people feel heard and valued. The safest spaces for conversation are those where vulnerability meets respect. Like any strong structure, these relationships need time and consistent care - each honest interaction adding another layer of reliability.

The Role of Nonverbal Communication

Our bodies speak volumes before we utter a word. A well-timed nod or open posture can convey more than paragraphs of explanation. Consider how crossed arms might shut down dialogue, while leaning slightly forward invites connection. The most skilled communicators harmonize their words and body language like a well-rehearsed duet.

Play unlocks creative potential, serving as children's first language of innovation. Through role-playing and scenario-building, young minds explore endless possibilities. This unstructured experimentation lays the foundation for flexible thinking that lasts a lifetime. The sandbox, it turns out, might be the most important classroom.

Budgeting and Cost Estimation with AR: Realistic Expectations

Understanding Budgeting Fundamentals

Financial roadmaps require both vision and pragmatism. A well-constructed budget acts as guardrails for spending while allowing room for adjustments. Like gardening, it involves regular pruning and nurturing - cutting excess while investing in growth areas. The most effective budgets breathe with changing circumstances rather than resisting them.

Key Components of Cost Estimation

Predicting expenses resembles weather forecasting - both art and science. The sharpest estimators account for hidden variables like administrative shadows that stretch longer than anticipated. They build in cushions for unexpected storms while preparing for sunny financial days. Thorough cost mapping turns financial guesswork into educated projections.

Techniques for Budgeting and Cost Estimation

Approaches vary like culinary styles - some prefer building flavors from individual ingredients (bottom-up), while others start with the finished dish in mind (top-down). Activity-based costing works like a microscope, revealing the cellular structure of expenses. The method matters less than the mindset: flexible yet precise, detailed yet adaptable.

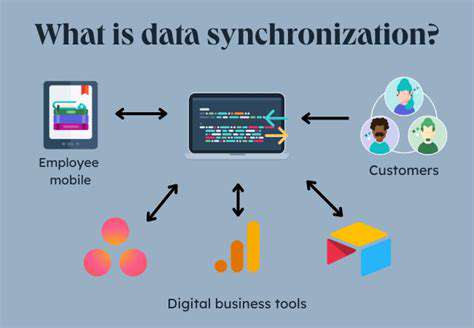

Tools and Resources

Modern budgeting tools act like financial dashboards, displaying vital metrics at a glance. The right software transforms number-crunching from chore to strategic exercise. Yet even the shiniest tools can't replace human judgment - which is why seasoned financial advisors remain invaluable navigators through fiscal complexities.

Read more about AR Assisted Home Renovation Planning Tools for Spouses

Hot Recommendations

- AI for dynamic inventory rebalancing across locations

- Visibility for Cold Chain Management: Ensuring Product Integrity

- The Impact of AR/VR in Supply Chain Training and Simulation

- Natural Language Processing (NLP) for Supply Chain Communication and Documentation

- Risk Assessment: AI & Data Analytics for Supply Chain Vulnerability Identification

- Digital twin for simulating environmental impacts of transportation modes

- AI Powered Autonomous Mobile Robots: Enabling Smarter Warehouses

- Personalizing Logistics: How Supply Chain Technology Enhances Customer Experience

- Computer vision for optimizing packing efficiency

- Predictive analytics: Anticipating disruptions before they hit